IPO-bound Wakefit is facing a test of faith. While the D2C giant has managed to carve its niche in India’s mattress market, its ambition to dominate the broader furniture and home solutions sector presents a far greater challenge to its public market debut. So, can it ace the challenge?

Not An Easy Ride: While mattress is its home turf, Wakefit’s weak link is its wooden furniture business, which is infamous for its complex supply chains, high logistical costs, price sensitivity, regional preferences, and intense competition from unorganised players.

Making matters worse is the rising competition from entrenched players like Sheela Foam and Duroflex as well as newer entrants like SleepyCat, vying for market share. However, not all is doom and gloom.

Tailwinds Cushioning Wakefit: The biggest arrow in the D2C brand’s quiver is its end-to-end control over the entire value chain, which helps the company keep manufacturing costs low. Besides, mattresses drive 60% of Wakefit’s total revenue, providing stability in an otherwise volatile furniture market.

With profitability key for a strong stock market debut, the company also kept a tight leash on its books in the past few fiscals:

- Against an EBITDA loss of INR 74.9 Cr in FY22, Wakefit churned an EBITDA profit of INR 65.8 Cr in FY24

- Operating revenue increased from INR 632.6 Cr in FY22 to INR 986.3 Cr in FY24

What Does The Jury Say? Beyond the vanity metrics, industry experts believe that the long-term success of Wakefit will hinge on expanding beyond mattresses, while maintaining growth in Tier II and Tier III cities. Further, an effective omnichannel strategy could also enable the company to capitalise on changing consumer habits and significantly drive demand for its home and furnishing category.

But, as the startup tiptoes its way to become India’s first listed D2C mattress brand, can Wakefit wake up to a blockbuster IPO, too?

From The Editor’s DeskBlip Shuts Down: Barely a year after beginning operations, the fashion quick commerce startup has shut shop. The startup, which delivered apparel in Bengaluru within a 30-minute window, decided to shut operations due to lack of capital.

Startup Funding Tanks: Indian startups raised $132.9 Mn across 17 deals last week, down 58% from the $314.6 Mn secured by 21 startups in the preceding week. Infinity Fincorp and Varthana took home the biggest cheques last week at $70 Mn and $18.6 Mn, respectively.

New-Age Tech Stocks Shine: Defying the bearish sentiment in the broader Indian equity market last week, a majority of new-age tech stocks ended the week in the green. Of the 32 startups under Inc42’s coverage, shares of 22 companies gained in a range of 0.02% to 12%.

Fractal Nets INR 49 Cr: The SaaS unicorn’s cofounder and CEO Srikanth Velamakanni has infused around $5.6 Mn in the company. This comes as the startup, which offers advanced analytics solutions to enterprises globally, is looking to file its DRHP soon for a $500 Mn IPO.

Lendingkart Finance Slips Into Red: The NBFC arm of the fintech startup reported a net loss of INR 288.3 Cr in FY25 against a profit of INR 60.1 Cr in FY24. Operating revenue fell 24.5% YoY to INR 862.2 Cr. Meanwhile, founder Harshvardhan Lunia stepped down as MD.

Crisis Unfolding At Fi Money: The neobank is grappling with serious challenges as its core lending business has failed to gain traction, which has led to a cash crunch and mass layoffs. Fi is now facing a shrinking runway, product cutbacks, and an uncertain future.

Vaaree Bags $4.6 Mn: The home decor marketplace has raised the capital from its existing investors PeerCapital and Peak XV’s Surge Ventures. The platform sells a range of home furnishing and decor products via its marketplace.

ESOPs Galore At Swiggy: The foodtech major’s board approved the allotment of 38.8 Lakh equity shares under its ESOP 2024 scheme for eligible employees. Based on the stock’s last close of INR 385.15 per share, the newly allotted equity shares are worth INR 149.67 Cr.

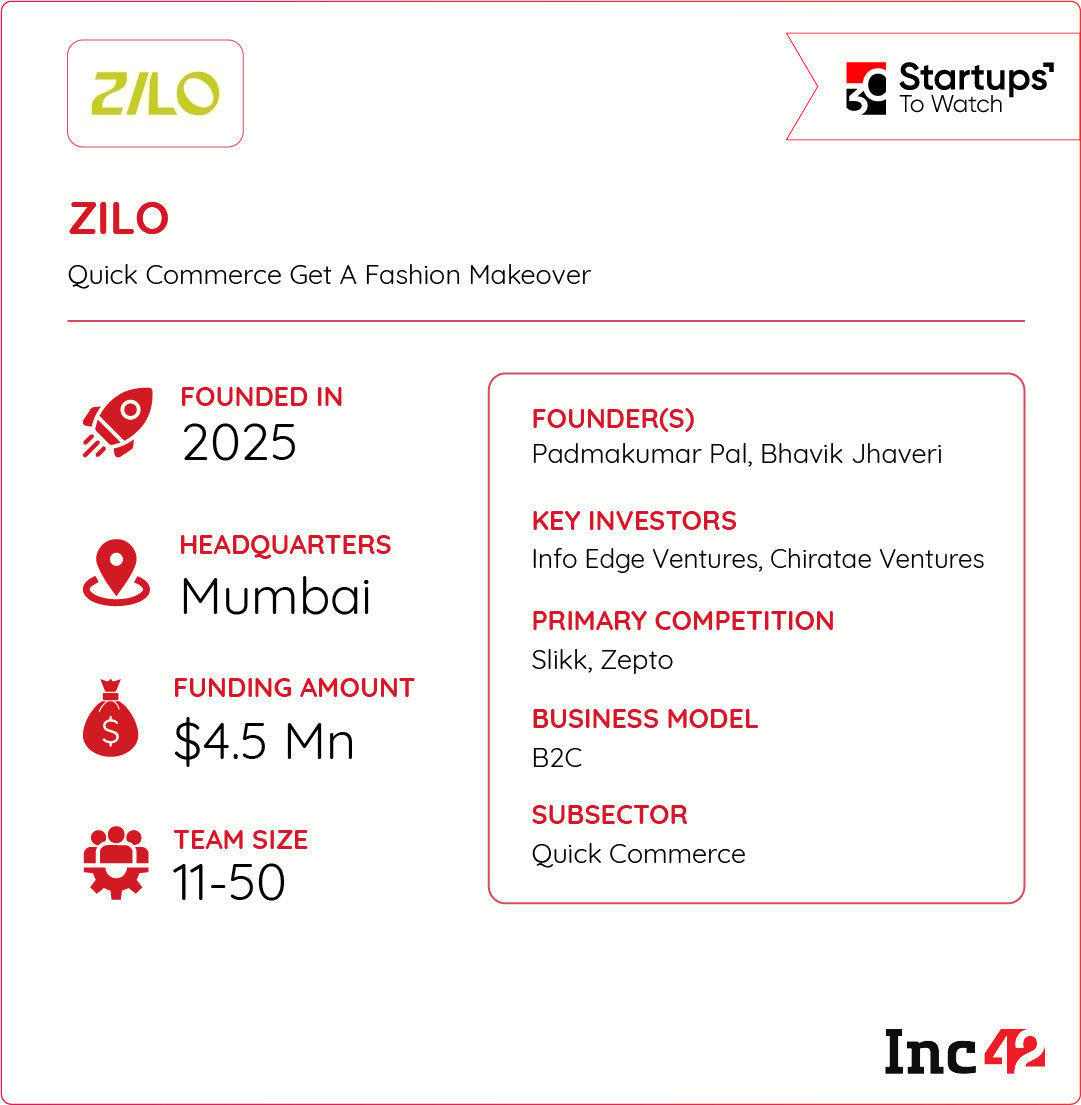

Inc42 Startup Spotlight ZILO’s 30-Minute Wardrobe PlayWhile quick commerce has transformed how Indians buy groceries, fashion remains largely untouched by this revolution due to reasons like inventory management, high return rates, sizing issues and what not. Undeterred by these challenges, Padmakumar Pal Bhavik Jhaveri founded ZILO earlier this year to bring quick deliveries for impulse-driven fashion shoppers.

The Home Trial Experience: ZILO enables customers to order trending outfits from top brands and get them delivered in minutes. What sets the platform apart is that customers can order multiple sizes, and a ZILO representative waits 30 minutes at the doorstep for the user to try and return what doesn’t fit.

Capitalising On The Experience: Leveraging their years of expertise as executives at ecommerce giants Flipkart and Myntra, ZIILO cofounders have built the startup’s business model on solving for convenience, fit issues, and return friction — something only a few fashion platforms offer right now.

Backed by marquee names like Info Edge Ventures and Chiratae, the Mumbai-based startup has already raised more than $4.5 Mn within months of its inception. With India’s quick commerce market projected to become a $40 Bn market opportunity by 2030, can ZILO find success by blending style with 30-minute convenience?

The post Wakefit’s High-Stakes IPO, Blip Shuts Down & More appeared first on Inc42 Media.

You may also like

Alex de Minaur's Katie Boulter remark speaks volumes amid Carlos Alcaraz 'girlfriend issue'

Death toll in Hyderabad toddy tragedy rises to seven

ITV Coronation Street's star's health battle that saw her quit iconic role

Republicans don't fear a backlash on immigration. They should.

Seaside village with rainbow homes and sandy beach is 'UK's Riviera'